In an increasingly digital world, some bits of paperwork have begun to seem not only pointless but also something of an inconvenience. Some documents are important, and can’t simply be digitised or thrown away. However, there are plenty of things on paper that you can easily get rid of. As long as you dispose of any sensitive documentation in a secure way, you can shred and recycle the papers that you no longer need. Deciding what to keep and what to throw away can be tricky. If you’re not sure what you should be keeping and what can go, use this guide to work out what’s what.

Personal Documents

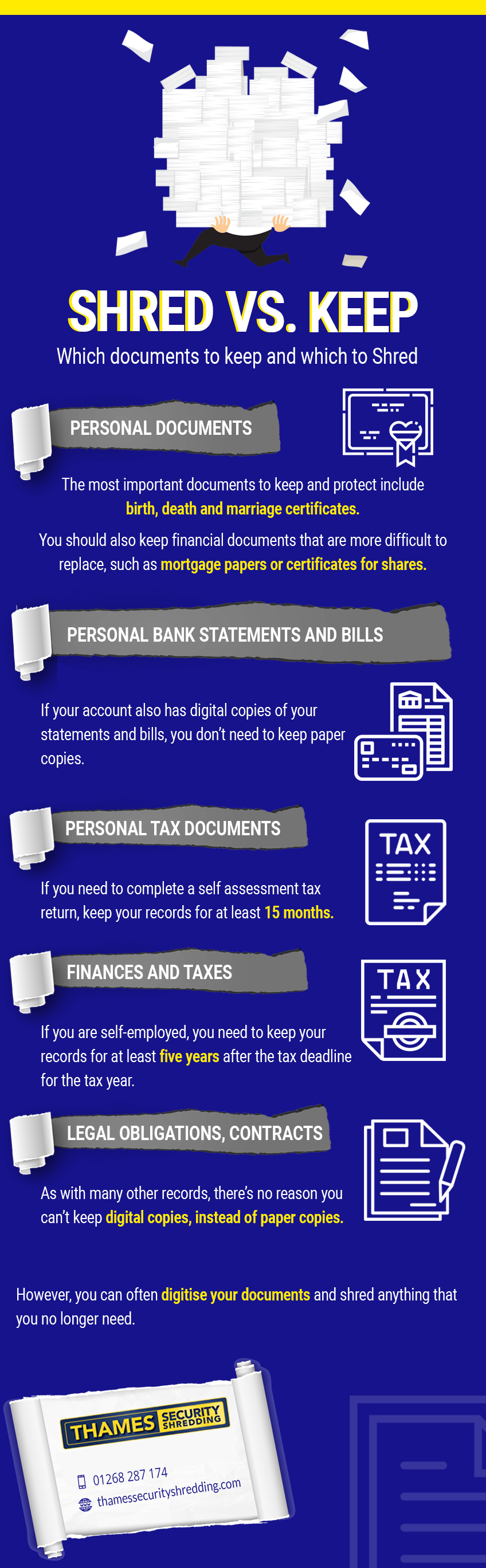

There are various documents that you might have at home that are pretty important to keep. These documents are rarely irreplaceable, but they’re likely to cost both time and money if you need to replace them. The most important documents to keep and protect include birth, death and marriage certificates, as well as other personal documents that you might need to provide as evidence in various situations. You could require your birth certificate to apply for a passport or a decree absolute to prove divorce if you get remarried. It doesn’t cost much to order a new birth certificate, for example, but it’s always best to have one in your possession.

Other documents that you might want to keep include copies of wills or any important contracts. You should also keep financial documents that are more difficult to replace, such as mortgage papers or certificates for shares or Premium Bonds.

Personal Bank Statements and Bills

When it comes to regular financial documents, such as bank statements and utility bills, it’s up to you if you want to keep them. If you only have them on paper, it’s a good rule of thumb to keep them for up to two years. They can be used as useful evidence for many things, helping you to prove your income, address and other information.

However, many people now have online bank accounts and online accounts for their utilities and other services. If your account also has digital copies of your statements and bills, you don’t need to keep paper copies too. You can download the documents from your accounts just to be safe if you want to ensure you have copies of them. It is useful to keep copies of documents from when you open new accounts, especially if you fear you might lose or forget the information you need to deal with your accounts online or over the phone.

Personal Tax Documents

You should also keep your tax information for at least a couple of years after the end of the tax year that they relate to (the tax year ends on April 5th). Payslips, P45s and other documents are useful for various things, from proving income to dealing with any disputes. If you need to complete a self assessment tax return, keep your records for at least 15 months afterwards, as advised by HMRC.

Business Documents

Whether you’re a sole trader or you run a limited company, there can be a lot more documentation involved compared to your personal life. From legal documents to financial information, it’s important to keep good records for tax purposes and for the health of your business

Finances and Taxes

If you are self-employed, you need to keep your records for at least five years after the tax deadline for the tax year. For example, for the 2019/2020 tax year, you will need to keep your records for five years from January 31st 2021, so until at least January 31st 2026. However, you don’t necessarily have to keep these records on paper. You can digitise everything, as long as you do it the right way. If you have paper documents that you want to digitise, you should scan both the front and back of each page.

You also need to keep information relating to VAT, and even when using Making Tax Digital, you might still need to keep various paper documents. After filing your taxes, a copy of your tax return or filed accounts will also be useful, but you don’t have to print them out.

Limited companies need to keep their records for six years after the financial year that they relate to. They might need to keep them for longer if there are transactions that cover multiple accounting periods or the company has bought something, such as equipment, that they expect to last longer than six months. In addition to accounting records, the company needs to keep information about the company, such as directors and shareholders, loans and mortgages, and transactions when someone buys shares.

Legal Obligations, Contracts and Other Important Documents

There are other records that your business might be legally required to keep. For example, if you manufacture or sell furniture, you will need to keep records relating to the fire safety of the products that you handle. As with many other records, there’s no reason you can’t keep digital copies, instead of paper copies.

Another important type of document that your business might have on paper is contracts of various kinds. Even these can be dealt with completely digitally now thanks to the ability to digitally sign a document. However, many people do still sign documents by hand. Again, you could choose to scan these contracts to digitise them, but keeping the original signed copy is a smart idea.

There are plenty of important paper documents that you should keep or might want to keep for peace of mind. However, you can often digitise your documents and shred anything that you no longer need. If you have already digitised your papers, your have documents older than five or six years, or you just have lots of junk mail, you can choose to get rid of it all. Use a secure shredding service to shred any sensitive paperwork so that you can be sure no information will get into the wrong hands. Thames Security Shredding can help you.