You may be bombarded with receipts, bills, pay stubs, taxes, bank statements and other financial documents if your files aren’t digital-based. It is crucial that you are aware that not all documents should be kept. There are some documents that you must dispose of which is why you need to know documents to keep or shred.

Furthermore, if you don’t know how long it is required to keep documents, then you will face challenges like paper clutter. It is better to act fast than to wait until it becomes a heap. You can start by consulting a professional that provides charts for how long you need to keep documents. Here, we provide detailed information on what documents to shred or keep and when to shred them.

While we are currently living in a digital era, paper consumption is still relatively high. To reduce clutter and free up valuable space, both home and business owners need to spend time year-round reviewing paper stacks and shredding old documents.

The first step is to filter as many irrelevant papers as possible from the vital ones. You can start by getting your documents such as banking statement, utility bill, and receipt delivered electronically. Also, cancelling subscriptions to the magazine that you are not reading will reduce the cluster of papers. By following these suggestions, you will save yourself the hassle of shredding old or new documents.

Now that you have minimised your exposure to unnecessary documents, the next step is to know the chart of how long to keep relevant documents. Not all old documents should be disposed of, which is why you should know what to keep before shredding. During this phase, you might face challenges such as: What documents are you supposed to keep or shred? How long do I need to keep documents or bills before shredding? How long should a landlord keep old leases?

Continue to read for solutions to every question above and more.

What Documents To Keep

Firstly, what is shredding?

Shredding is the act of cutting or tearing into shreds or unorganised pieces. A document shredding is an irreversible process, so you must separate what to shred from what to keep. For instance, documents that contain classified data can be used for criminal purposes and should be shredded by a reputable firm.

If your document has any confidential data like signatures, passwords, and financial statements, then you must safeguard it. We have sped up your shredding process by classifying such vital documents. Not only do we provide information on the ‘when’, but we also let you know what documents to keep and what to shred. Below are classifications of the documents to keep for a lifetime or at least, long-term:

CERTIFICATES:

– Birth certificate

– Marriage certificates

– Baptismal certificates

– Death certificates

LEGAL PAPERS:

– Divorce papers

– Adoption papers

– Wills

– Powers of attorney

– Passports

– Social Security cards

– Driver’s licenses

RECORDS:

– Employment records

– Medical records

– Retirement and pension records

– Military records

– Academic records

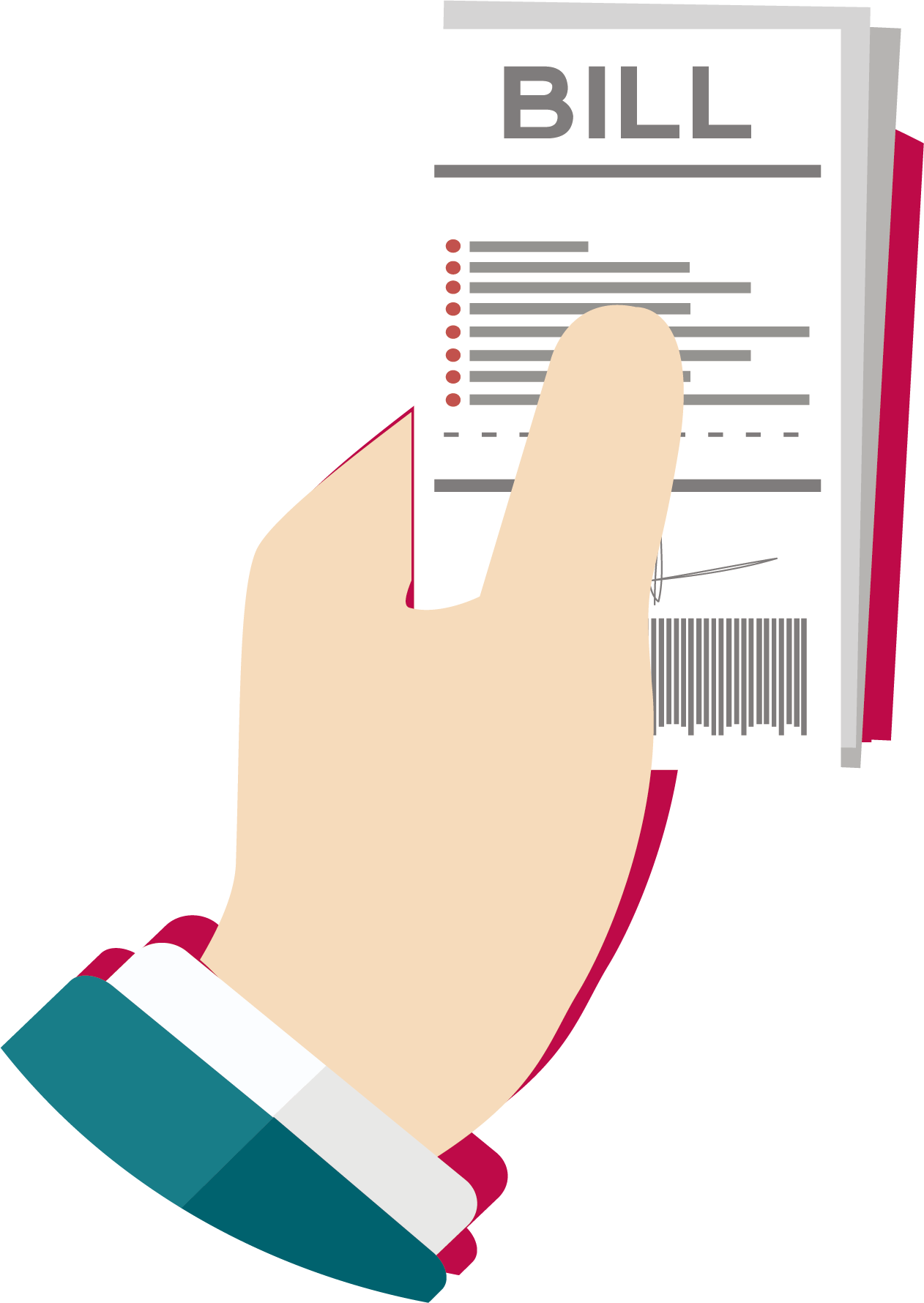

How Long Should I Keep Documents?

Read the following to get an idea of how long to keep different documents according to their classifications:

STATEMENTS:

Generally, you should keep either a digital or hard copy of the past year’s worth of your monthly bank and credit card statements. However, the protocol of when to shred documents like statements varies according to the financial institution. Find out more below.

Credit card statements: These statements can be shredded once they are reviewed for inaccuracies unless proof of purchase is required for warranty or tax purposes. You should safeguard these statements until you’ve confirmed the charges and have proof of payment. In case you require them for tax deductions, you should keep for three years.

Bank statements: Statements should be reviewed every month and stored for year-end accounting purposes. Once taxes are filed, documents can be shredded and, if necessary, your financial institution should be readily available. If your bank offers online statements, you can switch to receiving your bank documents digitally and cut down on paper.

Icon made by Freepik from www.flaticon.com

Investment statements: Statements should be kept on file until the end of the year for the annual valuation. Store for at least three years, as you may need the document for the capital gains tax. Records like these assist you in tracking your cost basis and the taxes you owe when you sell stocks or properties. Once you receive the annual summaries and taxes are filed, you can shred your monthly and quarterly statements.

VOUCHERS:

These documents include any information you might need in the future to defend yourself against potential lawsuits. Furthermore, we will provide vital but often overlooked information like how long a landlord should keep old leases.

Investment acquisition: Documentation should be kept as a purchase record and destroyed only when taxes are sold and subsequently filed.

Lease dossier: It is important that landlords know how long to keep documents such as leases. Securely store these papers until the end of the mortgage or lease term.

Documentation of payroll: Since there is a lot of vital information in this type of document, they should be stored upon receipt. Once pay stubs are compared at year-end with employer records, they can be shredded. You should also hold on to pay stubs so that you can use them to verify the accuracy of your Form W-2 when tax season arrives.

Manuals and warranties: These items should be maintained for the duration of ownership and shredded after.

Receipts: Keep all receipts required for tax purposes and shred the rest. Nevertheless, you can store your warranty or make a return after filing.

Records of taxes: Tax returns and all subordinate files should be stored for at least seven years. Also, if you file a claim for a loss from an unfounded deduction, keep your tax records for eight years. You can proceed to make digital copies of the important documents before shredding.

BILLS:

Bills are also part of the documents that you should know how long to keep. Sometimes, people assume that after settling the bills, they can discard them, but that is wrong. There is a stipulated time for particular bills, which is why you should know how long should you keep them before shredding.

Utility Bills: Store this kind of bills for one year and discard afterwards. The only exception is if you’re claiming a home office tax deduction, in which case you must keep them for three years.

If you own your business, you may need tax-related bills for your utility cell phone and cable. Nonetheless, you can eliminate them as soon as you confirm that your payment has been processed. What’s more, you can use your monthly statement for the disposal of bank withdrawal and deposit slips after the affirmation.

Medical Bills: Keep medical expense receipts for one year as your insurance company may request evidence of a doctor’s visit or other medical claims verification. If your medical expenses amounted to more than 7.5% of your adjusted gross income for 2017 or 2018, you could deduct them.

However, there have been recent developments. Note that you can only deduct the total unrefunded allowable medical expenses for the year that exceed 10% of your adjusted gross income. If you want that deduction, then you will need to reserve the medical records for three years as per tax records.

CONFIDENTIAL INFORMATION:

Social security cards: Any documents that contain private information should be shredded to ensure that they do not fall into the wrong hands.

Icon made by monkik, Freepik from www.flaticon.com

Insurance policy: Records should be safely stored as long as the policy is in place. You are permitted to shred as soon as the policy is outdated.

Cheque dissolution: Depending on your financial institution’s policies, cheques can either be destroyed after a year. In other cases, you can shred the one with you if they have been recorded with your bank.

It is ultimately important to know how long it is needed to keep documents, but there are some basic guidelines to follow regarding documentation. They are:

– Safeguard all legal papers

– Store tax information indefinitely

– Hold franchises and deeds until you sell them

Procedures For Converting To Digital-based

With digital-based records, you do not have to bother yourself with the chore of what to shred and what to keep. After you have followed our chart regarding how long is required to keep documents, the next best thing is to do the following:

First procedure:

You must prepare:

– A scanner

– A secure storage location: It is advisable to store it in a folder, on a computer system. Also, you can back the file up in your cloud or an external hard drive. We recommend this solution because it is time for you to go digital and save space!

Second procedure:

Take the subsequent steps meticulously;

– Create specific folders for different types of documents, e.g. certificate, records, legal papers etc.

– Then scan and store each document according to the content in a folder. To describe it, be sure to give each one a unique filename so that it can be found quickly via the search function of your computer.

Multiple apps are also available to help you record and store a variety of documents quickly. Many can be managed through your smartphone or tablet, so when you’re nowhere near your home computer, you can get rid of paperwork. You must also inform your business associates and banks about your migration to the digital platform.

Use and frequently change complex passwords to keep your account information safe. Make sure your combination of username and password is different from those you use for personal email, online merchants, and social media accounts. It is also a good idea to protect your computer with antivirus software. Godspeed!